vectorbt - 분할매수 + MA Gap ZScore

1Pager

Hypothesis

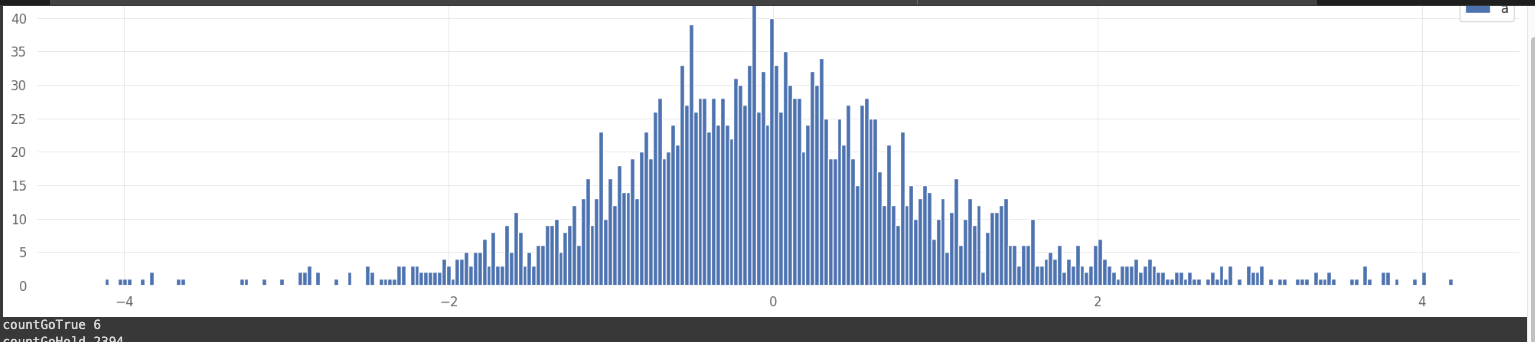

1.현재 가격과 이동평균선 사이의 Gap이 존재한다.

- 그 Gap에 대한 데이터를 샘플링 한다.

- Gap데이터를 모아서 평균 및 표준정규분포 곡선을 그린다.

- 그 정규분포곡선에서 하위 1%일때가 매수하기 좋은 시점이다.

- 의미 : 지금까지의 Period 중 가장 저가에 매수하는 것

주의

- 상승장 only

- 충분히 학습기간이 필요하기에 10일 이상 매매를 금지한다. (초기 데이터의 이상치 제거 필요)

- 미래 데이터를 미리 가져와서 평균치를 내면 안되므로 expanding 함수를 이용한다.

2.분할 매수를 한다.

- 시그널 이후 진입시 size값을 이용해서 진입한다.

3.가중 분할 매수를 한다.

- MA12 가중치 2

- MA24 가중치 8

4.분할매수 Level1적용한다.

- 최소 10번에 나누어서 매수

- 각 시행마다 가중치 매수를 진행한다.

Long Position

- MA12 ZScore 하위 1%

- MA12 ZScore 하위 1%

Short Position

long only

- stoploss 30%

Result - BTC/USDT, 1h

import numpy as np

import pandas as pd

import ccxt

import ta

import vectorbt as vbt

import quantstats as qs

import warnings

import time

from datetime import datetime, timedelta

import matplotlib.pyplot as plt

from scipy.stats import norm

# 데이터 호출 함수

def getHourlyOHLCV(days=100, ticker='BTC/USDT'):

startSince = datetime.now() - timedelta(days)

dfOHLCV = pd.DataFrame(columns=['Time', 'Open', 'High', 'Low', 'Close', 'Volume'])

since = int(startSince.timestamp() * 1000)

prevSince = None

while True:

data = ccxt.upbit().fetch_ohlcv(ticker, '1h', since)

df = pd.DataFrame(data, columns=['Time', 'Open', 'High', 'Low', 'Close', 'Volume'])

df['Time'] = pd.to_datetime(df['Time'], unit='ms') # ms(long) > datetime

dfOHLCV = pd.concat([dfOHLCV, df], ignore_index=True)

since = int(dfOHLCV['Time'].iloc[-1].timestamp() * 1000) + 1 # +1ms for no dedup

if since != None and prevSince == since:

break

prevSince = since

time.sleep(0.1)

dfOHLCV = dfOHLCV.drop_duplicates(subset=['Time']) # dedup

dfOHLCV = dfOHLCV.set_index('Time').resample('1H').ffill() # backfill prev data

return dfOHLCV

# 이상값 제거

def remove_outliers(series):

rev_range = 3 # 제거 범위 조절 변수

level_1q, level_3q = series.quantile(0.25), series.quantile(0.75)

IQR = level_3q - level_1q

return series[(series <= level_3q + (rev_range * IQR)) & (series >= level_1q - (rev_range * IQR))]

# ---- layer:data

dfOHLCV = getHourlyOHLCV(days=100,ticker="LINK/KRW")

# ---- layer:indicator

df = dfOHLCV.copy()

df['RowNum'] = df.reset_index().index

df['MA4'] = ta.trend.SMAIndicator(df['Close'],4).sma_indicator()

df['MA12'] = ta.trend.SMAIndicator(df['Close'], 12).sma_indicator()

df['MA24'] = ta.trend.SMAIndicator(df['Close'], 24).sma_indicator()

df['MA72'] = ta.trend.SMAIndicator(df['Close'], 72).sma_indicator()

# zscore

df['MA12Gap'] = df['Close'] - df['MA12']

df['MA12ZScore'] = (df['MA12Gap'] - df['MA12Gap'].expanding().mean()) / df['MA12Gap'].expanding().std()

df['MA12ZScore'] = remove_outliers(df['MA12ZScore'])

# ---- layer:signal

# long only

df['SignalMA12ZScore'] = np.select( [ df['MA12ZScore'] < df['MA12ZScore'].quantile(0.01), df['MA12ZScore'] > df['MA12ZScore'].quantile(0.99), ],[1,0],0 )

# ---- layer:position

cond_go = [ (df['SignalMA12ZScore'] == 1) & (df['RowNum'] > 12*10), df['SignalMA12ZScore'] == -1 ]

df['go'] = np.select(cond_go, [1,-1], 0)

df['go'] = df['go'].mask(df['go'] == df['go'].shift(1), 0) # 최초값유지

df['size'] = (df[['go']].expanding().sum()*10).abs() # 분할매수 사이즈

# ---- layer:anomalo

plt.figure(figsize=(25,5))

plt.grid(True)

plt.hist([df['MA12ZScore']],bins=300,label=['a'])

plt.legend()

plt.show()

benchmarkTotlaReturns = ((df['Close'].iloc[-1] - df['Close'].iloc[0]) / df['Close'].iloc[0])*100

lastSize = df['size'][-1]

countGoTrue = df['go'].value_counts()[1]

countGoHold = df['go'].value_counts()[0]

countSignalMA12ZScoreTrue = df['SignalMA12ZScore'].value_counts()[1]

countSignalMA12ZScoreFalse = df['SignalMA12ZScore'].value_counts()[0]

print(f"countGoTrue {countGoTrue}")

print(f"countGoHold {countGoHold}")

print(f"countSignalMA12ZScoreTrue {countSignalMA12ZScoreTrue}")

print(f"countSignalMA12ZScoreFalse {countSignalMA12ZScoreFalse}")

print(f"benchmarkTotlaReturns {benchmarkTotlaReturns}")

print(f"lastSize {lastSize}")

# layer:trading

pf = vbt.Portfolio.from_signals(

df['Close'],

entries = (df['go']==1), # long 포지션 진입

exits = (df['go']==-1), # long 포지션 탈출

sl_stop = 0.3, # stop loss, 10% 손해 > 손절

sl_trail = True, # 트레일링 스탑

fees = 0.0006, # 거래수수료 ( bybit ) 주문시 post-only

# allow_partial = True,

size_type = 1, # Value 1 | Percent 2 | TargetValue 4

size = df['size'],

log=True,

freq='1H',

accumulate = True # 분할 매수 가능하게, 기본값=False > 매수 후 Hold

# post-only True -> 무조건 지정한 가격에만 체결 / 수수료 낮게 지불 가능 / 실수해서 손해보는 경우가 없다. (시장가 체결 되는 케이스)

# tp_stop = 0.09, # take profit, 9% 이익 > 익절

# short_entries = (df['go']==-1), # short 포지션 진입

# short_exits = (df['go']==1) # short 포지션 탈출

)

print(pf.stats())

# layer:visualize

pf.plot().show()

# layer:report

pf.qs.plot_snapshot()

qs.plots.snapshot(pf.benchmark_returns())

# layer:notice

buyNotice = (df.tail(4)['go'] == 1).any()

stats

Start 2023-11-25 08:00:00

End 2024-03-04 07:00:00

Period 100 days 00:00:00

Start Value 100.0

End Value 168.937901

Total Return [%] 68.937901

Benchmark Return [%] 68.358269

Max Gross Exposure [%] 100.0

Total Fees Paid 0.322645

Max Drawdown [%] 19.575762

Max Drawdown Duration 30 days 12:00:00

Total Trades 3

Total Closed Trades 2

Total Open Trades 1

Open Trade PnL 64.883777

Win Rate [%] 50.0

Best Trade [%] 14.855785

Worst Trade [%] -9.403154

Avg Winning Trade [%] 14.855785

Avg Losing Trade [%] -9.403154

Avg Winning Trade Duration 47 days 14:00:00

Avg Losing Trade Duration 10 days 12:00:00

Profit Factor 1.375634

Expectancy 2.027062

Sharpe Ratio 2.920345

Calmar Ratio 29.524251

Omega Ratio 1.09474

Sortino Ratio 4.242156

Result - LINK/KRW, 1h - TC2

매도 : -10% drawdown 손실

stats

benchmark total return 43.658413340070744

Start 2023-11-25 08:00:00

End 2024-03-04 07:00:00

Period 100 days 00:00:00

Start Value 100.0

End Value 134.324584

Total Return [%] 34.324584

Benchmark Return [%] 43.658413

Max Gross Exposure [%] 100.0

Total Fees Paid 0.888398

Max Drawdown [%] 24.620326

Max Drawdown Duration 54 days 06:00:00

Total Trades 8

Total Closed Trades 7

Total Open Trades 1

Open Trade PnL 10.461915

Win Rate [%] 42.857143

Best Trade [%] 25.874756

Worst Trade [%] -9.663215

Avg Winning Trade [%] 17.630381

Avg Losing Trade [%] -6.444443

Avg Winning Trade Duration 13 days 10:20:00

Avg Losing Trade Duration 7 days 15:15:00

Profit Factor 1.949065

Expectancy 3.408953

Sharpe Ratio 1.879882

Calmar Ratio 7.863738

Omega Ratio 1.064586

Sortino Ratio 2.685104

dtype: object

Result - LINK/KRW, 1h - TC3

매도 : -20% drawdown 손실

stats

Start 2023-11-25 08:00:00

End 2024-03-04 07:00:00

Period 100 days 00:00:00

Start Value 100.0

End Value 129.473206

Total Return [%] 29.473206

Benchmark Return [%] 43.759474

Max Gross Exposure [%] 100.0

Total Fees Paid 0.265968

Max Drawdown [%] 30.675143

Max Drawdown Duration 55 days 07:00:00

Total Trades 3

Total Closed Trades 2

Total Open Trades 1

Open Trade PnL 48.190837

Win Rate [%] 0.0

Best Trade [%] -9.617927

Worst Trade [%] -10.079824

Avg Winning Trade [%] NaN

Avg Losing Trade [%] -9.848875

Avg Winning Trade Duration NaT

Avg Losing Trade Duration 16 days 20:00:00

Profit Factor 0.0

Expectancy -9.358816

Sharpe Ratio 1.638765

Calmar Ratio 5.108964

Omega Ratio 1.053357

Sortino Ratio 2.355005

Result - LINK/KRW, 1h - TC3

매도 : -10% drawdown 손실

stats

Result - LINK/KRW, 1h - TC4

매도 : -30% drawdown 손실 매집 : df['MA12ZScore'] < df['MA12ZScore'].quantile(0.01)

stats

Start 2023-11-25 09:00:00

End 2024-03-04 08:00:00

Period 100 days 00:00:00

Start Value 100.0

End Value 135.95403

Total Return [%] 35.95403

Benchmark Return [%] 43.574297

Max Gross Exposure [%] 100.0

Total Fees Paid 0.059964

Max Drawdown [%] 25.721672

Max Drawdown Duration 35 days 13:00:00

Total Trades 1

Total Closed Trades 0

Total Open Trades 1

Open Trade PnL 35.95403

Win Rate [%] NaN

Best Trade [%] NaN

Worst Trade [%] NaN

Avg Winning Trade [%] NaN

Avg Losing Trade [%] NaN

Avg Winning Trade Duration NaT

Avg Losing Trade Duration NaT

Profit Factor NaN

Expectancy NaN

Sharpe Ratio 1.880543

Calmar Ratio 8.04062

Omega Ratio 1.060568

Sortino Ratio 2.71913

dtype: object

Result - LINK/KRW, 1h - TC5

매도 : -30% drawdown 손실

매집 : df['MA12ZScore'] < df['MA12ZScore'].quantile(0.01) , 2

매집 : df['MA24ZScore'] < df['MA24ZScore'].quantile(0.01) , 8

# ---- layer:indicator

df = dfOHLCV.copy()

df['RowNum'] = df.reset_index().index

df['MA4'] = ta.trend.SMAIndicator(df['Close'],4).sma_indicator()

df['MA12'] = ta.trend.SMAIndicator(df['Close'], 12).sma_indicator()

df['MA24'] = ta.trend.SMAIndicator(df['Close'], 24).sma_indicator()

df['MA72'] = ta.trend.SMAIndicator(df['Close'], 72).sma_indicator()

# zscore

df['MA12Gap'] = df['Close'] - df['MA12']

df['MA12ZScore'] = (df['MA12Gap'] - df['MA12Gap'].expanding().mean()) / df['MA12Gap'].expanding().std()

df['MA12ZScore'] = remove_outliers(df['MA12ZScore'])

df['MA24Gap'] = df['Close'] - df['MA24']

df['MA24ZScore'] = (df['MA24Gap'] - df['MA24Gap'].expanding().mean()) / df['MA24Gap'].expanding().std()

df['MA24ZScore'] = remove_outliers(df['MA24ZScore'])

# ---- layer:signal

# long only

df['SignalMA12ZScore'] = np.select( [ df['MA12ZScore'] < df['MA12ZScore'].quantile(0.01), df['MA12ZScore'] > df['MA12ZScore'].quantile(0.99), ],[1,0],0 )

df['SignalMA24ZScore'] = np.select( [ df['MA24ZScore'] < df['MA24ZScore'].quantile(0.01), df['MA24ZScore'] > df['MA24ZScore'].quantile(0.99), ],[1,0],0 )

# ---- layer:position

cond_go = [ (df['RowNum'] > 12*10) & (df['SignalMA12ZScore'] == 1) , df['SignalMA12ZScore'] == -1 ]

df['go1'] = np.select(cond_go, [1,-1], 0)

df['go1'] = df['go1'].mask(df['go1'] == df['go1'].shift(1), 0) # 최초값유지

cond_go = [ (df['RowNum'] > 12*10) & (df['SignalMA24ZScore'] == 1) , df['SignalMA12ZScore'] == -1 ]

df['go2'] = np.select(cond_go, [1,-1], 0)

df['go2'] = df['go2'].mask(df['go2'] == df['go2'].shift(1), 0) # 최초값유지

result_df = pd.concat([(df[['go1']].expanding().sum()*2).abs(), (df[['go2']].expanding().sum()*8).abs()], axis=1 )

df['go'] = df['go1'] & df['go2']

df['size'] = result_df.sum(axis=1)

# df['size'] = (df[['go1']].expanding().sum()*1).abs() + (df[['go2']].expanding().sum()*5).abs() # 분할매수 사이즈

# ---- layer:anomalo

plt.figure(figsize=(25,5))

plt.grid(True)

plt.hist([df['MA12ZScore']],bins=300,label=['a'])

plt.legend()

plt.show()

benchmarkTotlaReturns = ((df['Close'].iloc[-1] - df['Close'].iloc[0]) / df['Close'].iloc[0])*100

lastSize = df['size'][-1]

countGoTrue = df['go'].value_counts()[1]

countGoHold = df['go'].value_counts()[0]

countSignalMA12ZScoreTrue = df['SignalMA12ZScore'].value_counts()[1]

countSignalMA12ZScoreFalse = df['SignalMA12ZScore'].value_counts()[0]

print(f"countGoTrue {countGoTrue}")

print(f"countGoHold {countGoHold}")

print(f"countSignalMA12ZScoreTrue {countSignalMA12ZScoreTrue}")

print(f"countSignalMA12ZScoreFalse {countSignalMA12ZScoreFalse}")

print(f"benchmarkTotlaReturns {benchmarkTotlaReturns}")

print(f"lastSize {lastSize}")

# layer:trading

pf = vbt.Portfolio.from_signals(

df['Close'],

entries = (df['go']>=1), # long 포지션 진입

exits = (df['go']<=-1), # long 포지션 탈출

sl_stop = 0.3, # stop loss, 10% 손해 > 손절

sl_trail = True, # 트레일링 스탑

fees = 0.0006, # 거래수수료 ( bybit ) 주문시 post-only

# allow_partial = True,

size_type = 1, # Value 1 | Percent 2 | TargetValue 4

size = df['size'],

log=True,

freq='1H',

accumulate = True # 분할 매수 가능하게, 기본값=False > 매수 후 Hold

# post-only True -> 무조건 지정한 가격에만 체결 / 수수료 낮게 지불 가능 / 실수해서 손해보는 경우가 없다. (시장가 체결 되는 케이스)

# tp_stop = 0.09, # take profit, 9% 이익 > 익절

# short_entries = (df['go']==-1), # short 포지션 진입

# short_exits = (df['go']==1) # short 포지션 탈출

)

print(pf.stats())

# layer:visualize

pf.plot().show()

# layer:report

pf.qs.plot_snapshot()

qs.plots.snapshot(pf.benchmark_returns())

# layer:notice

buyNotice = (df.tail(4)['go'] == 1).any()

stats

lastSize 108.0

Start 2023-11-25 09:00:00

End 2024-03-04 08:00:00

Period 100 days 00:00:00

Start Value 100.0

End Value 144.534144

Total Return [%] 44.534144

Benchmark Return [%] 43.574297

Max Gross Exposure [%] 100.0

Total Fees Paid 0.059964

Max Drawdown [%] 17.492328

Max Drawdown Duration 17 days 01:00:00

Total Trades 1

Total Closed Trades 0

Total Open Trades 1

Open Trade PnL 44.534144

Win Rate [%] NaN

Best Trade [%] NaN

Worst Trade [%] NaN

Avg Winning Trade [%] NaN

Avg Losing Trade [%] NaN

Avg Winning Trade Duration NaT

Avg Losing Trade Duration NaT

Profit Factor NaN

Expectancy NaN

Sharpe Ratio 2.563104

Calmar Ratio 16.213507

Omega Ratio 1.091704

Sortino Ratio 3.855461